Surprising numbers from the USDA WASDE report: Surprising numbers from the monthly World Agricultural Supply and Demand Estimates report (WASDE) released this month. The report reduced the national corn yield by over three bushels an acre from 183.1 to 179.3. This reduced overall bushels on the corn balance sheet by 276 million bushels. The national soybean yield was reduced by one bushel from 51.7 to 50.7. This reduced the soybean balance sheet by 95 million bushels. The report sent commodity markets much higher. Before the report corn was trading around $4.54 a bushel and soybeans were $9.92 a bushel. Currently, corn is trading around $4.87 a bushel and soybeans are $10.45 a bushel. The next big report will be estimates for corn and soybean acreage at the end of March. The big question will be, how many acres of corn will U.S. farmers plant in 2025? Watch this space.

Link: WASDE

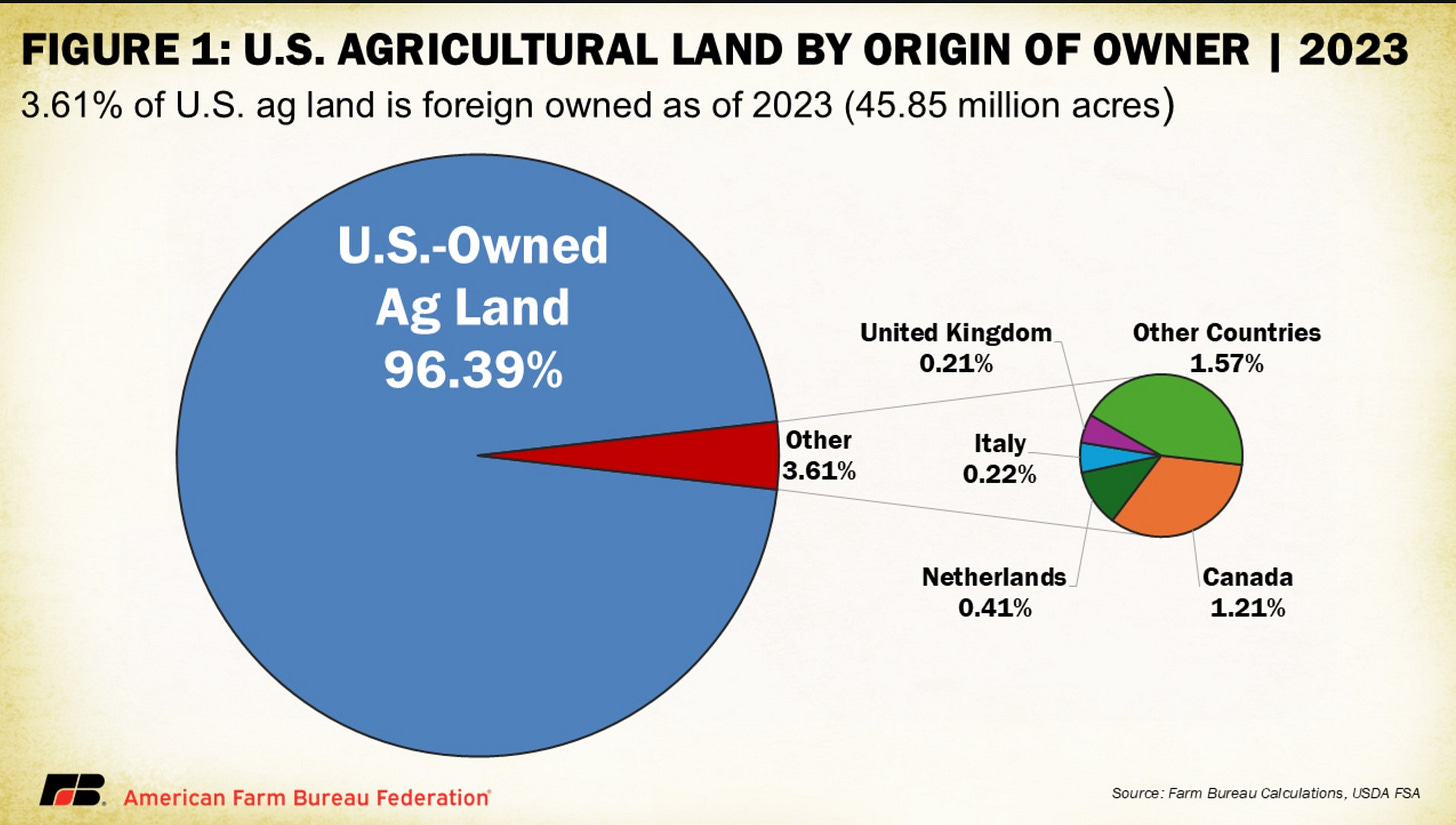

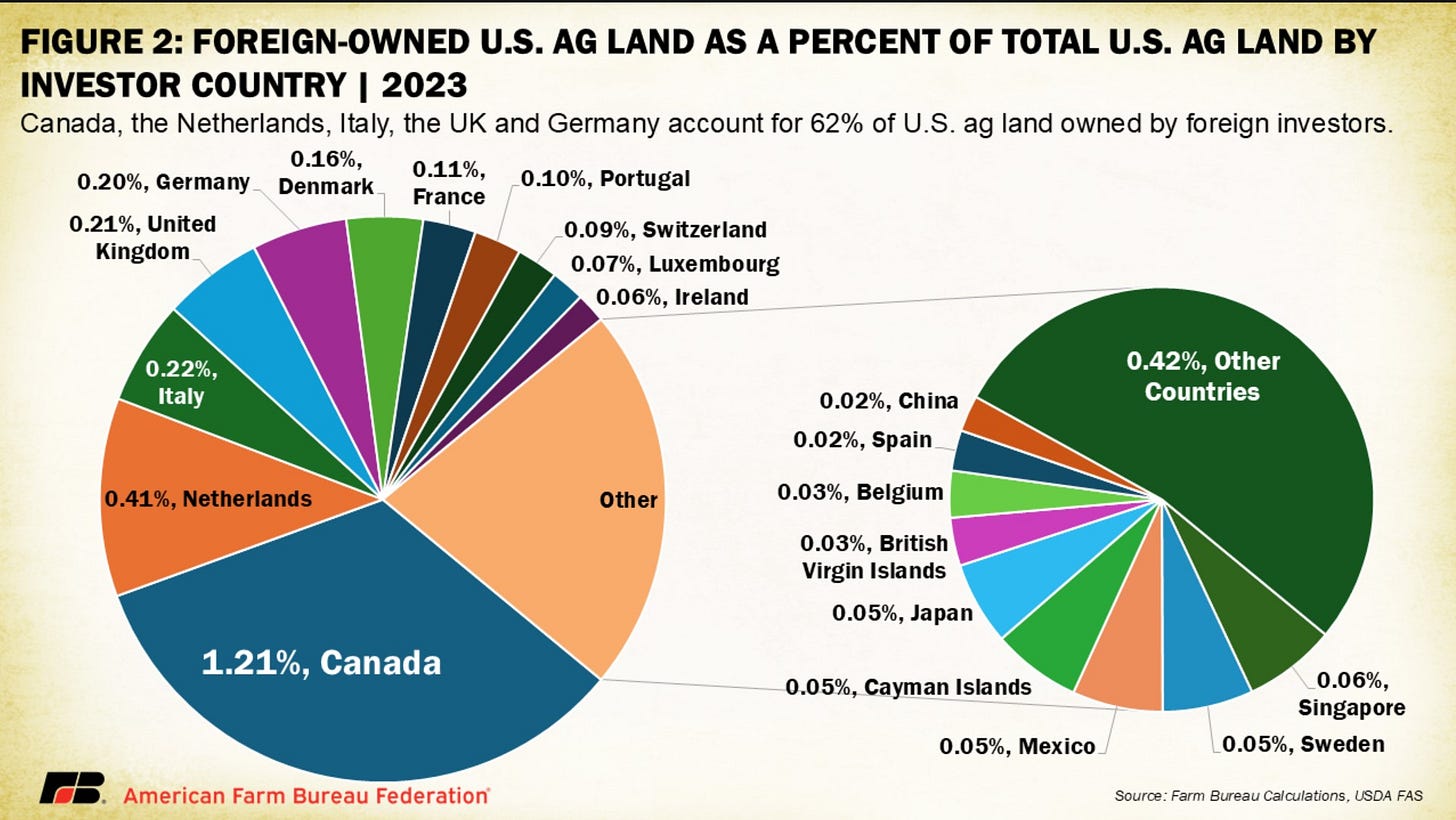

Farm Bureau study on Foreign Land Ownership: A study by the American Farm Bureau Federation showed how many acres of U.S. farmland are foreign-owned. According to the report “45.85 million acres of U.S. agricultural land were held by foreign investors in 2023.” The country with the largest amount of U.S. farmland ownership is Canada. Texas has the highest amount of land owned by foreign investors. The report also stated, “In 2023, 277,336 acres were linked to Chinese investors 0.02% of all privately held U.S. agricultural land”. Click on the link below to review the entire report.

Link: Foreign Footprints: Trends in U.S. Agricultural Land Ownership

Land Sales: Below are a few notable farmland sales from December.

69 acres sold in Shelby County, IA. The land had a CSR-2 rating of 51 and sold for $11,356 an acre, or $222 per CSR-2 point.

67 acres sold in Kossuth County, IA. The land had a CSR-2 rating of 84 and sold for $15,300 an acre, or $182 per CSR-2 point.

77 acres sold in Boone County, IA. The land had a CSR-2 rating of 84 and sold for $13,324 an acre, or $158 per CSR-2 point.

Check out the rest of the newsletter for important indicators to pay attention to that affect the land market and agriculture, as well as a video with notable land sales from across Iowa for December.

Commodity Markets:

Corn:

Feed demand: For 2023-2024 feed demand was 5.825 billion bushels. USDA’s latest estimates from the monthly World Agriculture Supply and Demand Estimates (WASDE) report were lowered to 5.775 billion bushels of feed and residual use for 2024-2025.

Why it Matters: Feed demand accounts for about 40% of corn usage. If wheat prices continue to decline this could affect corn demand for feed.

Ethanol: In 2024 ethanol demand was 5.478 billion bushels. The recent estimates from the monthly World Agriculture Supply and Demand Estimates (WASDE) raised those projections for 2024-2025 to 5.5 billion bushels.

Why it Matters: Ethanol makes up roughly 40% of corn usage. Margins have tightened recently with the rising cost of corn. Cheaper soybean meal could hurt demand for dried distiller grains (DDGs). Also, keep an eye out for tariffs on Canada. They are our biggest buyer of U.S. ethanol.

Exports: Projections for corn exports were 2.450 billion bushels for 2024-2025, down slightly from USDA’s last estimate of 2.475 billion bushels.

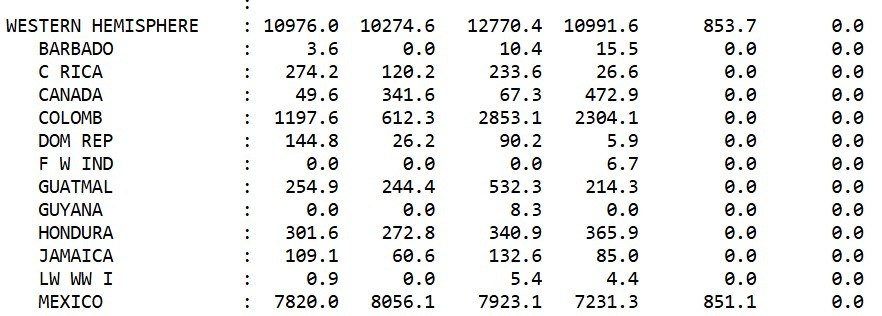

Why it Matters: Exports comprise about 20% of U.S. corn demand. Mexico was our largest buyer of U.S. corn last week. We have had strong sales of corn to Southeast Asia recently. Continue to watch for possible tariffs and their implications for corn exports.

Link: WASDE

Link: Exports

Soybeans:

Crush: The National Oilseed Processors Association (NOPA) crush data for December was 206 million bushels. Last year at this time it was 195 million bushels.

Why it matters: Roughly half of U.S. soybeans are used for crushing. Soybean oil goes into many products like coffee creamer, salad dressing, and mayonnaise. With crush plant expansion continuing across the United States, expect these numbers to continue higher.

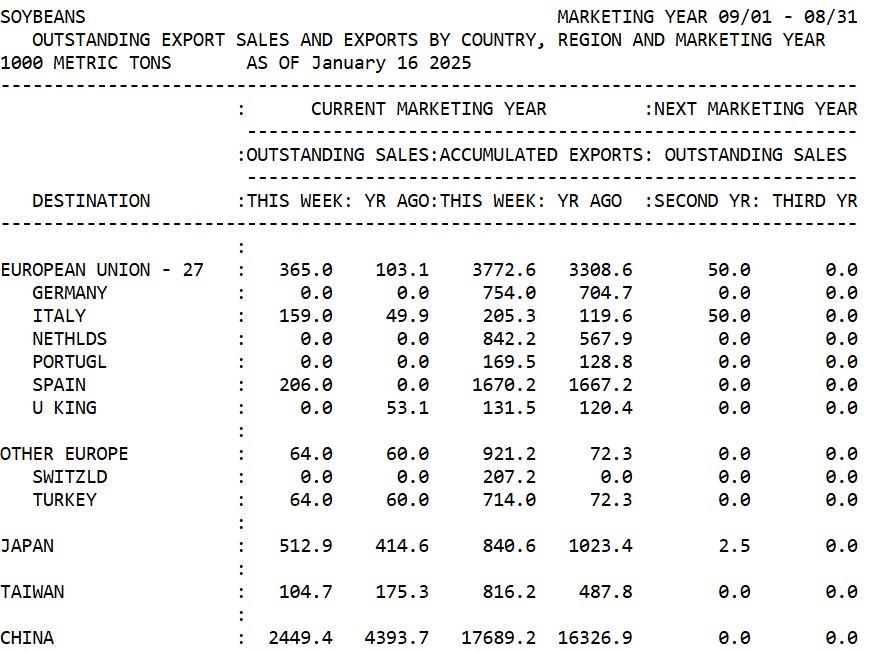

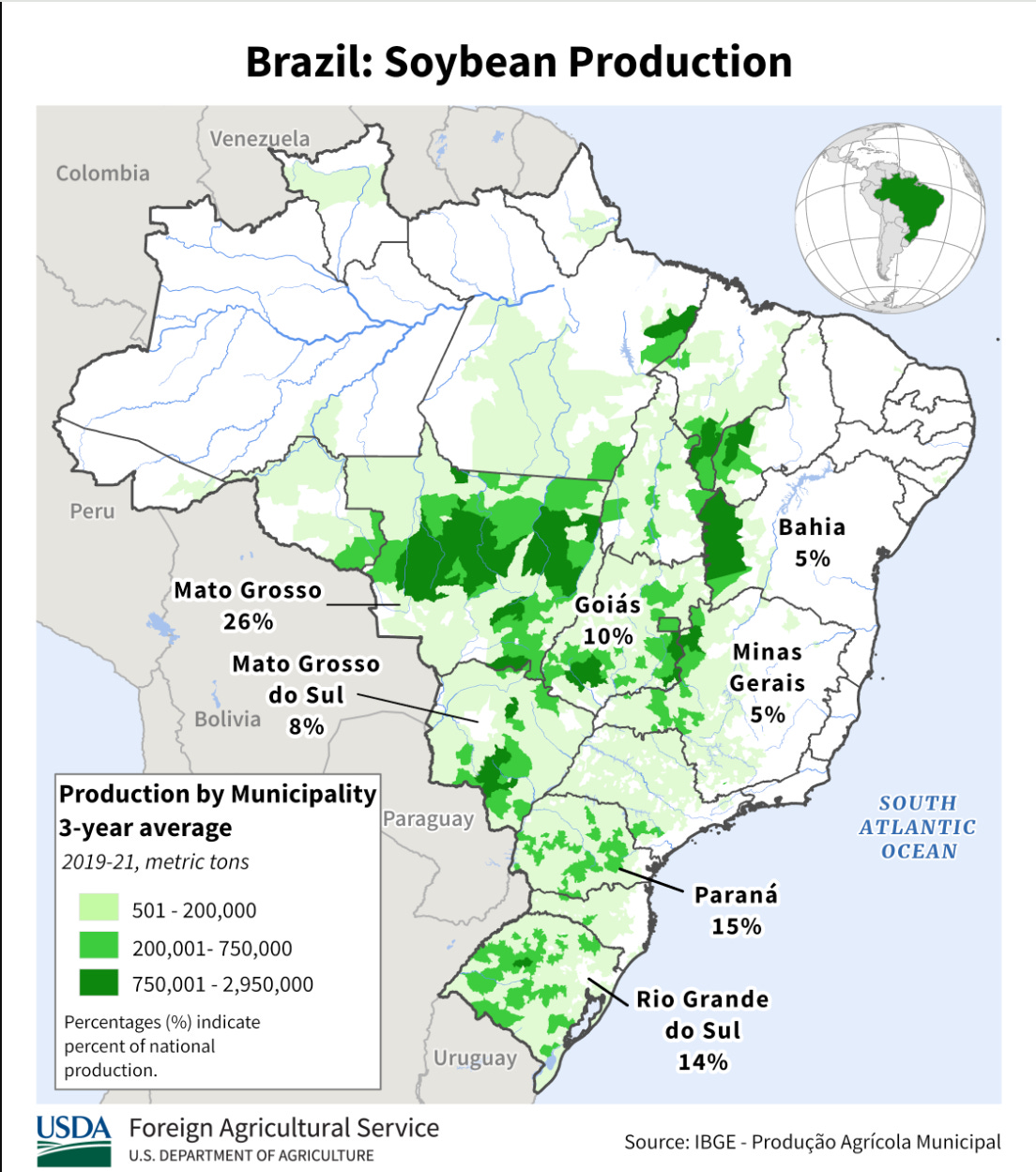

Exports: About half of our U.S. soybean crop is exported. The USDA export projections from the monthly World Agricultural Supply and Demand Estimates (WASDE) showed 1.825 billion bushels of soybeans estimated for export during the 2024/2025 marketing year, unchanged from the previous report. Last week China was our biggest buyer of soybeans. With a delay in South American soybean harvest, will this continue to help U.S. soybean exports?

Link: Exports

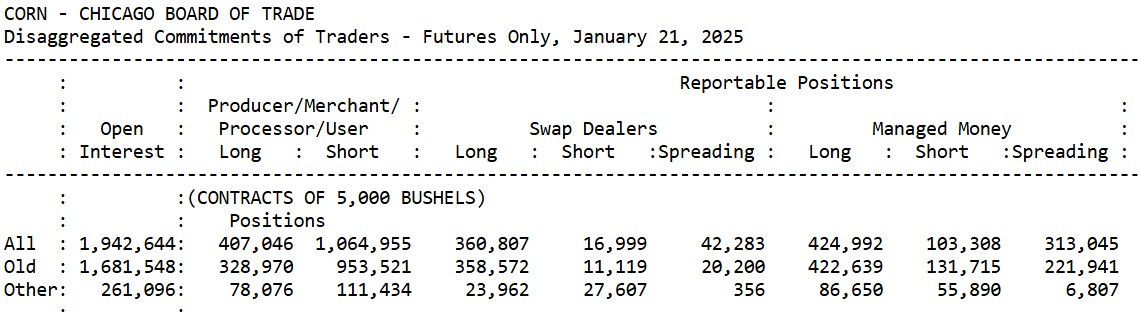

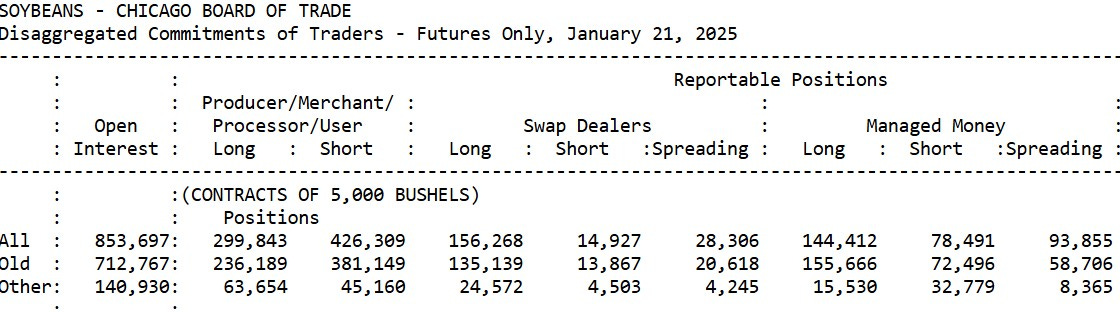

CFTC: The Commodity Futures Trading Commission (CFTC) shows that managed money has a long position in both the corn and soybean markets. Long corn contracts of (321,684) and long soybean contracts (65,921).

Why it matters: The funds hold a net long position in the corn and soybean market. Will they continue to be long the corn and soybean market in the coming weeks? If they start to unwind their long position, that could hurt both the corn and soybean market.

Link: CFTC

Interest Rates: The sources I am talking to say yearly operating notes range between 7.0%-8.0%. Last year at this time they ranged between 8-9%.

Why it matters: While these rates to borrow are lower than a year ago, they are significantly higher than a few years ago.

30-year mortgage rates: The current 30-year mortgage rate is 7%, compared to 6.5% a year ago.

Why it matters: Interest rates are a major factor in agriculture. If the Federal Reserve continues to cut interest rates this could spur investors back into the farmland market.

Inflation- Monthly Consumer Price Index (CPI) data showed a 2.9% year-over-year increase in their latest report.

Why it matters: The Federal Reserve is signaling more rate cuts in the coming months. However, it will be at a slower pace in 2025 compared to 2024.

Link: CPI

Fertilizer Prices: According to the USDA Production Cost Report, NH3 Anhydrous Ammonia averages $733 per ton, potash averages $447 per ton, and Phosphate (MAP) averages $766 per ton.

Why it matters: With tight margins for the 2025 crop year input prices which are always important to pay attention to will be especially important in 2025.

LINK: Illinois Production Cost

U.S. Drought Monitor:

Brazil Weather: Continue to watch the weather in South America. Currently, they are having some delays with their soybean harvest.

Link: Brazil Production Soybeans

Agriculture News of Note:

Notable Land Sales Video: Check out the video above for notable land sales from Iowa for December!

Thanks for reading the Corn Belt Newsletter! If you’re looking to buy or sell a farm or want an evaluation of your property reach out to me.

Contact information: Joshua Manske (Farm Realtor)

Cell: 515-707-1774

Email: joshuahmanske@gmail.com

Farm and Home Services LLC

Always well researched analysis. Thanks Josh.