Rural Main Street Index falls for the 14th straight month; Farmland to remain soft into 2025 according to the Federal Reserve; Farmland sales update

Corn Belt Newsletter for November

Main Street Index shows continued weakness in farm country: Creighton University’s Rural Mainstreet Index which provides analysis of the rural economy fell for the 14th straight month. With grain prices continuing to struggle, high input costs, (especially phosphate fertilizer) interest rates remaining elevated, and the possibility of new tariffs this shouldn’t be a surprise. Here are a few highlights from October’s survey:

“61.5% of bankers indicated that the financial position of farmers in their service area had deteriorated over the past six months. The remaining 38.5% reported that farmers’ financial position was unchanged over the past six months.”

“The farm equipment sales index for October slumped to 18.8 from 19.0 in September.“This is the 15th straight month that the index has fallen below growth neutral. Higher borrowing costs, tighter credit conditions, and farm income losses are having a negative impact on the purchases of farm equipment,” said Goss.

“On average, bank CEOs reported that over the past six months, only 18.1% of farmland buyers were non-farmer investors.”

LINK: Rural Mainstreet Index

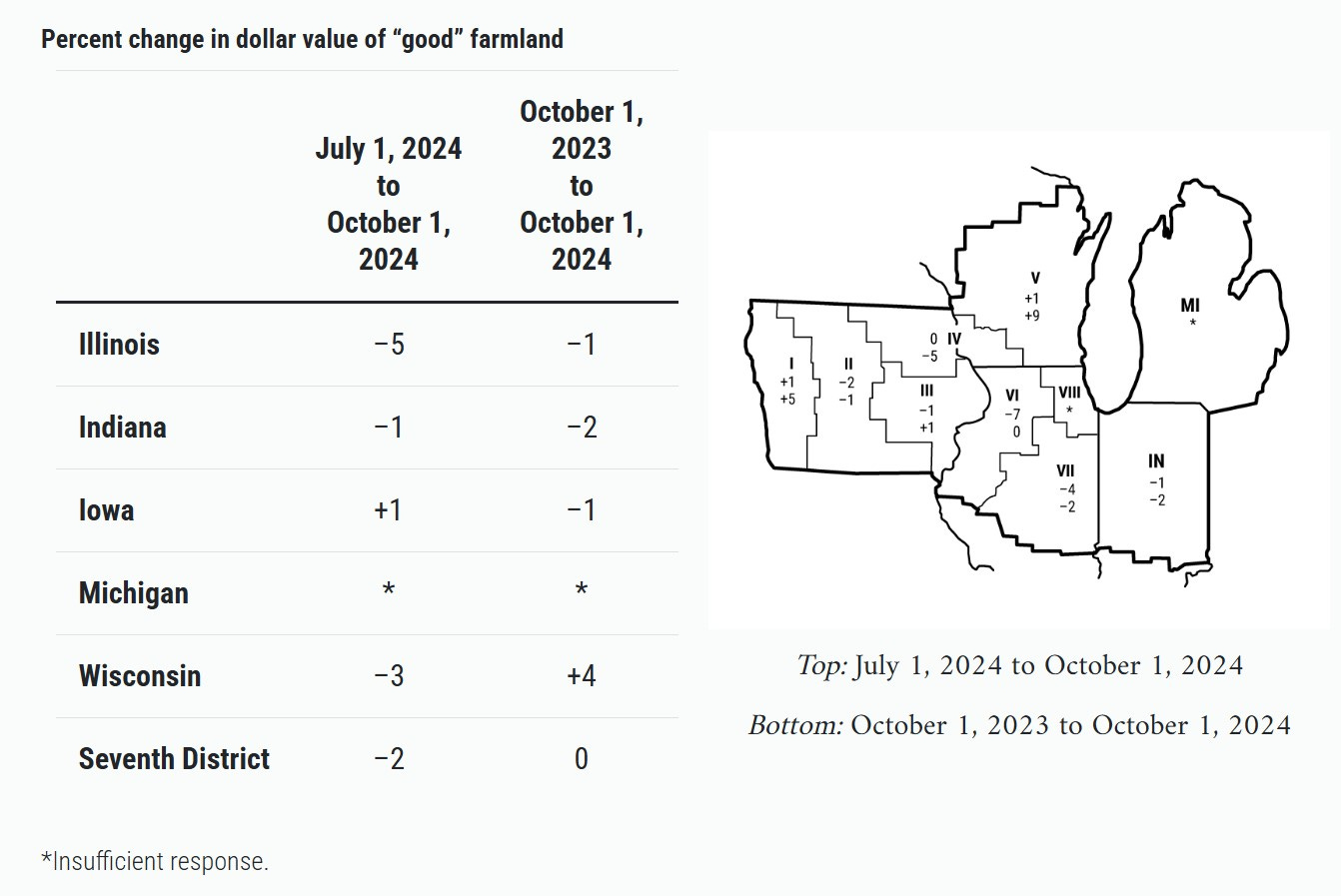

Chicago Federal Reserve Ag letter: The Chicago Fed released its quarterly agricultural letter. The report showed that land prices for District 7 were down 2% compared to a year ago. The Chicago Fed “expects land prices to remain soft in 2025.” Check out the link below for the entire report.

Link: Ag Letter

Farmland update: “Farmland interest rates are the highest since 2009” according to a survey conducted by the Federal Reserve Bank of Minneapolis. This will continue to put pressure on the land market. Farmland prices have remained steady despite headwinds of low commodity prices and high interest rates. Prime farmland in the right area is still bringing a premium. See notable sales below.

Link: Minneapolis Federal Reserve

Land Sales: Below are a few notable farmland sales from October.

80 acres sold in Cherokee County, IA. The land had a CSR-2 rating of 92 and sold for $15,300 an acre, or $166 per CSR-2 point.

69 acres sold in Keokuk County, IA. The land had a CSR-2 rating of 78 and sold for $14,700 an acre, or $213 per CSR-2 point.

91 acres sold in Pottawatomie County, IA. The land had a CSR-2 rating of 91 and sold for $17,900 an acre, or $196 per CSR-2 point.

National Corn Growers Association and the American Soybean Association release tariff study:

The National Corn Growers Association and the American Soybean Association released a study on the impact of tariffs on agricultural goods. I encourage everyone to read and share the report.

LINK: NCGA/ASA Tariff Study

Check out the rest of the newsletter for important indicators to pay attention to that affect the land market and agriculture, as well as a video with notable land sales from across Iowa for October.

Commodity Markets:

Corn:

Feed demand: For 2023-2024 feed demand was 5.775 billion bushels. USDA’s latest estimates from the monthly World Agriculture Supply and Demand Estimates (WASDE) report remain unchanged at 5.825 billion bushels of feed and residual use for 2024-2025.

Why it Matters: Feed demand accounts for about 40% of corn usage. At these price levels, feed demand should increase.

Ethanol: 2023 ethanol demand was 5.45 billion bushels. The recent estimates from the monthly World Agriculture Supply and Demand Estimates (WASDE) left those projections unchanged for 2024-2025 at 5.45 billion bushels.

Why it Matters: Ethanol makes up roughly 40% of corn usage. We have exported 37% more ethanol than a year ago. This has been spurred by other countries’ appetite for green fuels. As I have said in previous months, continue to watch for the development of sustainable aviation fuel. The 45Z tax credit and SAF won’t help prices in the short term but could be critical for supporting prices and demand in the future.

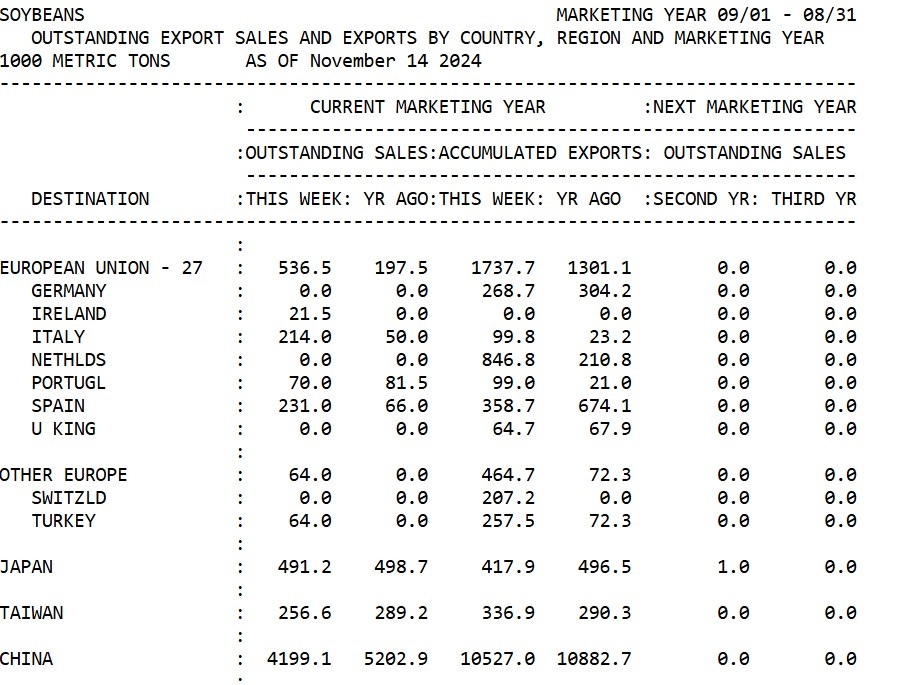

Exports: Projections for corn exports were 2.325 billion bushels for 2024-2025, unchanged from USDA’s last estimate of 2.325 billion bushels.

Why it Matters: Exports comprise about 20% of U.S. corn demand. Mexico is our largest buyer of U.S. corn. Last week’s biggest buyer of corn was Mexico. Keep an eye out for possible tariffs on Mexico in the coming months.

Link: WASDE

Link: Exports

Soybeans:

Crush: The National Oilseed Processors Association (NOPA) crush data for October was 199 million bushels. Last year at this time it was 189 million bushels. This is up 10 million bushels from a year ago. October was a record for soybean crush.

Why it matters: Roughly half of U.S. soybeans are used for crushing. Soybean oil goes into many products like coffee creamer, salad dressing, and mayonnaise. With crush plant expansion continuing across the United States, expect these numbers to continue higher which should help support prices.

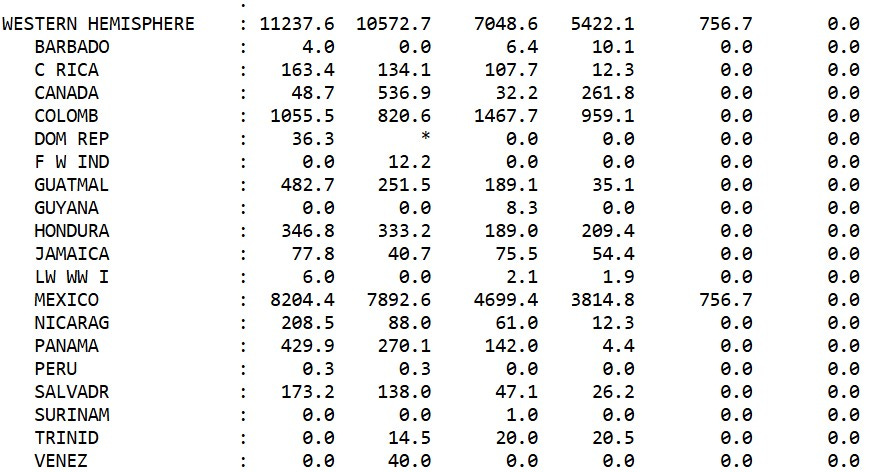

Exports: About half of our U.S. soybean crop is exported. The USDA export projections from the monthly World Agricultural Supply and Demand Estimates (WASDE) showed 1.825 billion bushels of soybeans estimated for export during the 2024/2025 marketing year. China has been our biggest buyer historically. Last week they were our biggest buyer of soybeans. Keep an eye on this space with the possibility of tariffs.

Link: Exports

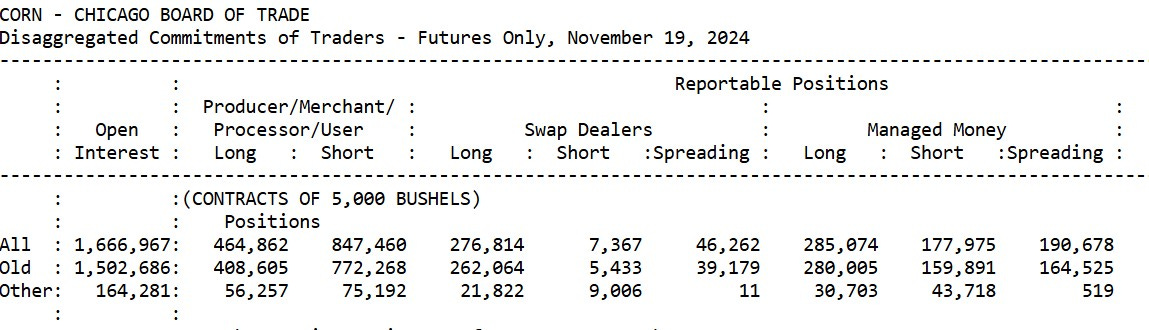

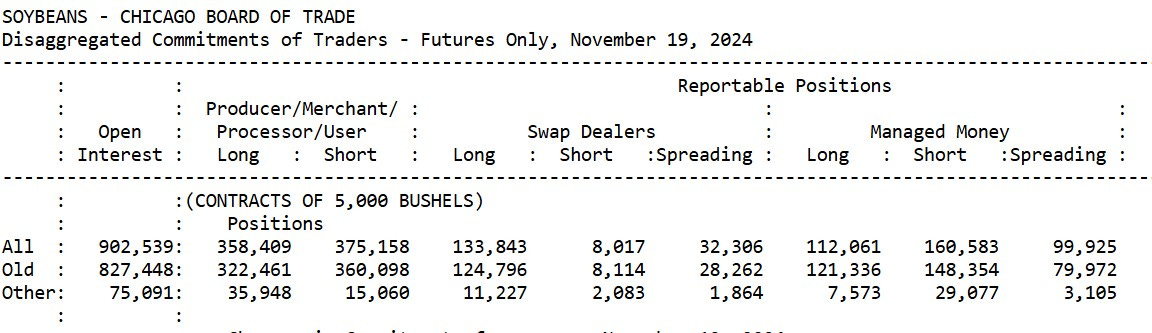

CFTC: Commodity Futures Trading Commission (CFTC) shows Managed Money has a long position in the corn market and a short position in the soybean market. Long corn contracts of (107,099) and short soybean contracts (48,522).

Why it matters: The funds now hold a net long position in the corn market. They still hold a net short position in the soybean market. This is the first time in about six months they have held a long position in the corn market. Continue to watch this space.

Link: CFTC

Interest Rates: The sources I am talking to say yearly operating notes are ranging between 7.0%-8.5%

Why it matters: Lower interest rates will start to help margins for those who borrow money from the bank.

30-year mortgage rates: The current 30-year mortgage rate is 6.5%, compared to 7.25% a year ago.

Why it matters: Interest rates are a major mover and line item when it comes to agriculture. Lower interest rates could spur investors to come back into the farmland market.

Inflation- Monthly Consumer Price Index (CPI) data showed just a 2.6% year-over-year increase.

Why it matters: It seems like the Federal Reserve has achieved a “soft landing.” With friendly inflation numbers, the Federal Reserve is signaling more rate cuts in the coming months.

Link: CPI

Fertilizer Prices: According to the USDA Production Cost Report NH3 Anhydrous Ammonia is averaging $685 per ton. Potash is averaging $458 per ton and Phosphate (MAP) is averaging $758 per ton.

Why it matters: With tight margins for the 2025 crop year input prices which are always important to pay attention to will be especially important in 2025.

LINK: Illinois Production Cost

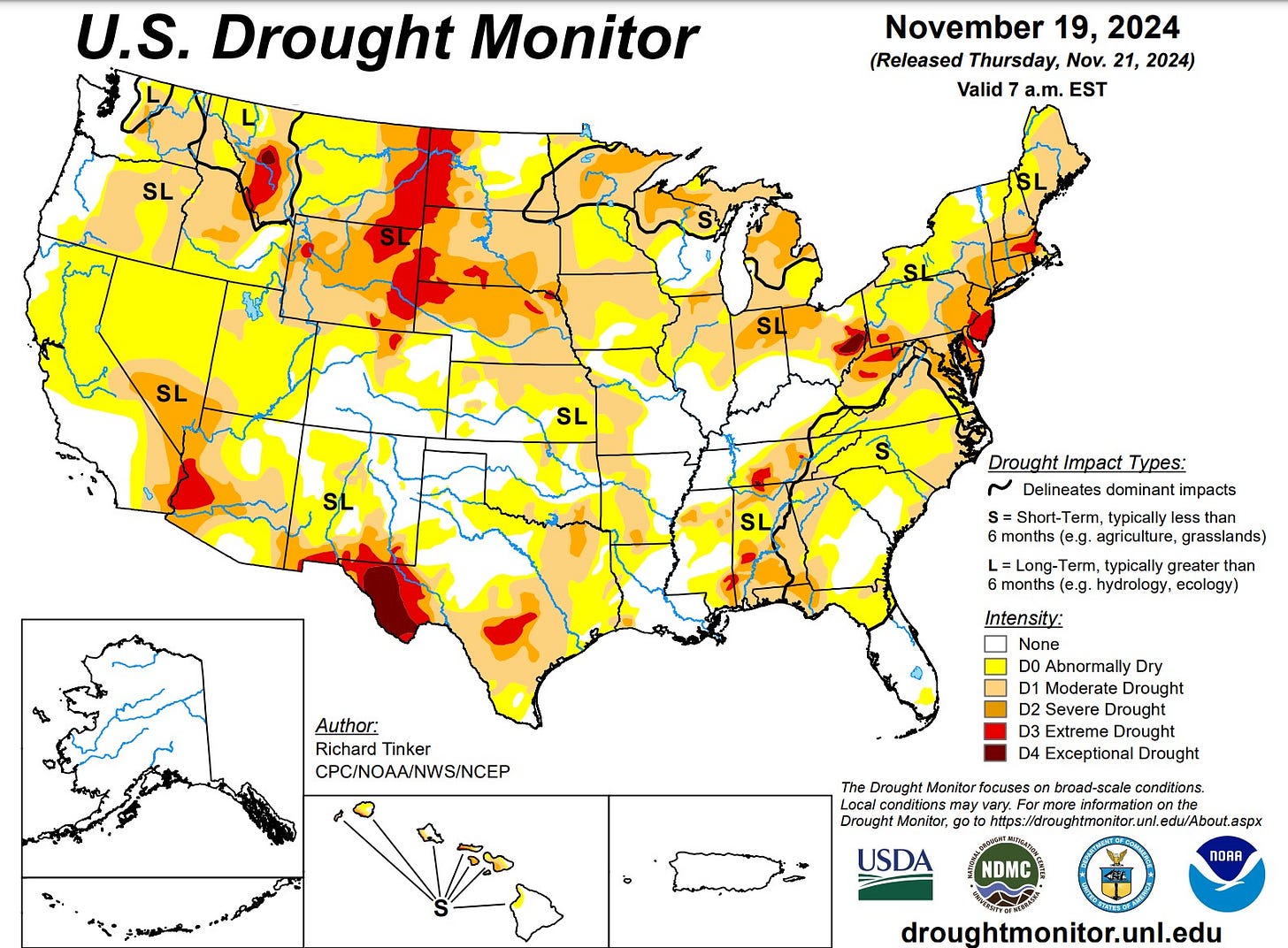

U.S. Drought Monitor:

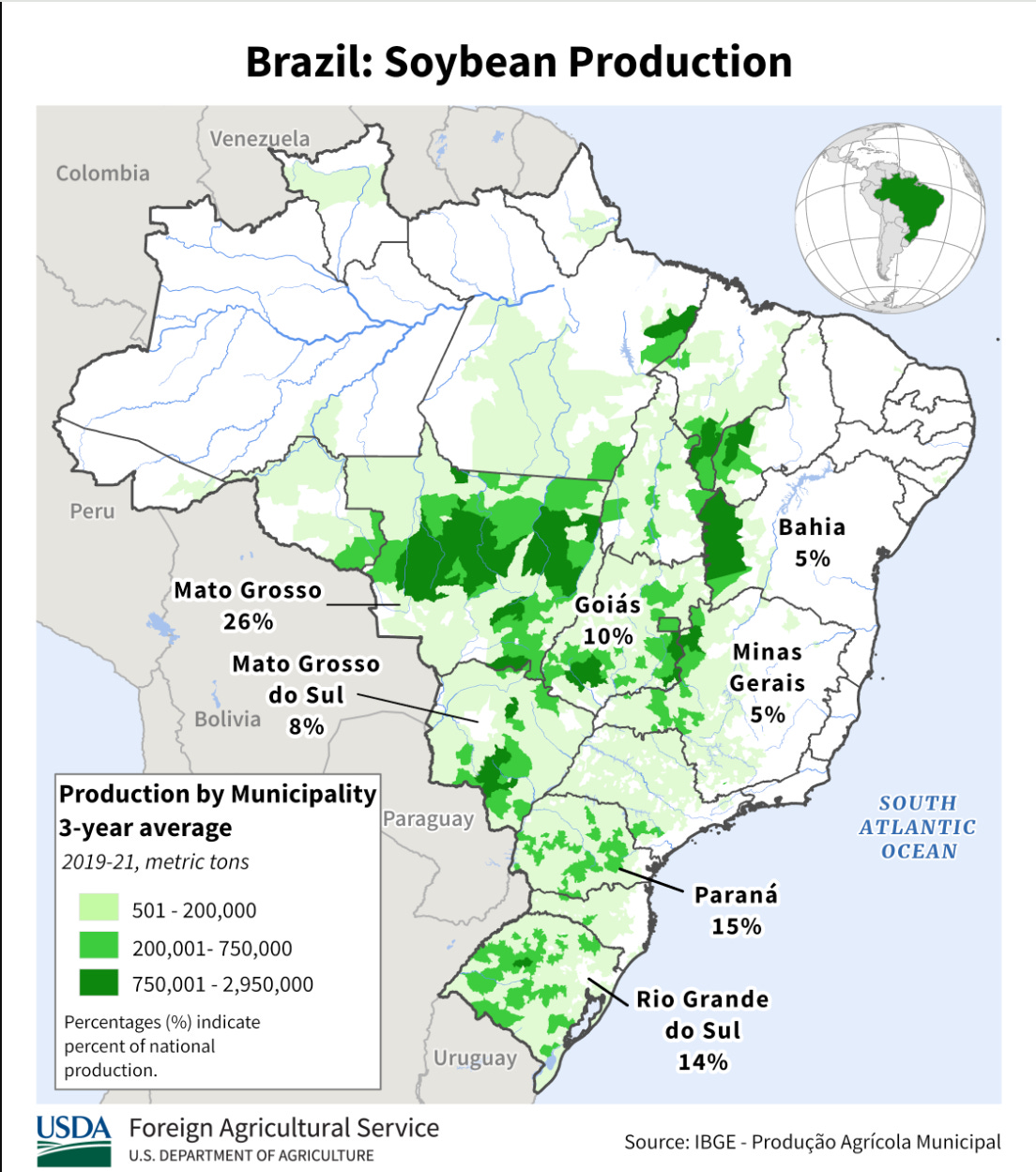

Brazil Weather: Pay attention to the major growing areas like Mato Grosso which comprise 26% of soybean production in South America. Continue to watch the weather in South America for any potential weather scares which would be a positive for the commodity markets. As of now, there is not much concern in Brazil as far as weather is concerned. Watch this space.

Link: Global Agricultural Monitoring

Link: Brazil Production Soybeans

Agriculture News of Note:

Get To Know Brooke Rollins, Nominee for Agriculture Secretary

US trade partners warn Trump tariffs would harm all involved

Notable Land Sales Video: Check out the video below for notable land sales from Iowa for October!

Thanks for reading the Corn Belt Newsletter! If you’re looking to buy or sell a farm or want an evaluation of your property reach out to me.

Contact information: Joshua Manske (Farm Realtor)

Cell: 515-707-1774

Email: joshuahmanske@gmail.com