September’s Lead story: Farm income is lower by almost 7%. Land prices are down over 8%.

USDA came out with their projections for net farm income and it was no surprise that it was lower for 2024. “In inflation-adjusted 2024 dollars, net farm income is forecast to decrease by $10.2 billion (6.8 percent) from 2023 to 2024.” The report said.

Corn and soybean prices have fallen substantially over the last nine months and input prices like phosphate are up 20%. Farmers are feeling the squeeze. Why is this happening? USDA is projecting a record crop. Too much supply and not enough demand. Exports have also struggled. Soybeans for example, even with China buying recently are behind on the number of sales we need in order to get a bump in the market. Combines are rolling across much of the corn belt. Keep an eye out for yield reports as they come in.

Link: Farm Income Sector Forecast from USDA

The Realtors Land Institute survey showed recently that land prices in Iowa are down over 8% year-over-year. With interest rates remaining high and commodities low this is not surprising. It will be interesting to see how the land market reacts to the Federal Reserve cutting interest rates by .50 basis points earlier this month. This will take some time to work its way into the market. Keep an eye on the Federal Reserve to see how many more rate cuts and how big those cuts will be in the coming months. With interest rates being a big factor in the land market, lower rates may bring some buyers back into the market.

Link: Iowa Realtors Land Survey

With farmers' balance sheets in the red, some members of Congress are talking about attaching aid to an extension of the Farm Bill. Farmers and consumers need an updated Farm Bill. It affects every American and is vital for our rural economies. Click on the link below to learn more about the farm bill.

Link: Farm Bill Primer

Check out the rest of the newsletter for important indicators to pay attention to that affect the land market and agriculture, as well as a video with notable land sales from across Iowa for August.

The front of the USDA building in Washington D.C. It says “Dedicated to the service of agriculture for the public welfare.”

Commodity Markets-

Corn

Feed demand- For 2023-2024 feed demand was 5.775 billion bushels. USDA’s latest estimates from the monthly WASDE report remain unchanged at 5.825 billion bushels of feed and residual use.

Why this Matters- Feed demand makes up about 40% of corn usage. At these price levels corn feed demand should stay about the same.

Link: WASDE

Ethanol- 2023 ethanol demand was 5.45 billion bushels. The recent estimates from the monthly World Agriculture Supply and Demand Estimates (WASDE) left those projections unchanged for 2024 at 5.45 billion bushels.

Why it Matters- Ethanol makes up roughly 40% of corn usage. We need more guidance on the 45Z tax credit. Continue to watch for development of the sustainable aviation fuel market. 45Z and SAF won’t help prices in the short term but could be critical for supporting prices in the future.

Link: WASDE

Exports- Projections for corn exports were updated to be 2.30 billion bushels for 2024. Up slightly from 2.29 billion bushels.

Why this Matters- Exports comprise about 20% of U.S. corn demand. Sales to Mexico have been good lately. Look for China to come in and buy U.S. corn especially if Brazil stays dry. Lower prices have increased our export opportunities. Last week’s biggest buyer of corn was Mexico.

Link:WASDE

Link: Exports

Soybeans-

Crush- The National Oilseed Processors Association (NOPA) crush data for August was 158 million bushels. Last year at this time it was 161.5 million bushels. These numbers are slightly lower due to many plants that were down for maintenance. This month’s data would be an outlier.

Why this matters- Roughly half of U.S. soybeans are used for crushing. Soybean oil goes into many products like your coffee creamer and mayonnaise. With crush plant expansion across the United States, expect these numbers to continue to trend upward.

Link: WASDE

Exports- About half of our U.S. soybean crop is exported. The USDA revised export projections from 1.70 billion bushels for 2023/2024 to 1.850 billion bushels for 2024/2025. China has been our biggest buyer historically. If Brazil has a good crop our exports to China will continue to suffer. Last week China was our biggest buyer of soybeans.

Link: WASDE

Link: Exports

CFTC- Commodity Futures Trading Commission (CFTC) shows Managed Money has a short position in the corn and soybean markets. Short corn contracts of (144,037) and short soybean contracts (112,752).

Why this matters- The funds still hold a net short position. It is less than it was a month ago. Continue to watch this space.

Link: CFTC

Interest Rates- The sources I am talking to say yearly operating notes range between 7.5%-8.5%

Why this matters- The Federal Reserve cut interest rates by .50 basis points in September. Lower rates will start to help margins for those who borrow money from the bank.

30-year mortgage rates- The current 30-year mortgage rate is 6% compared to a year ago when it was 7.25 %.

Why this matters- It continues to remain difficult to get a 3% cap rate on farmland. With interest rates being cut, will that start to bring back investors into the farmland market? Even with the Federal Reserve cutting interest rates borrowing costs remain high.

Inflation- Monthly Consumer Price Index (CPI) data showed just a 2.5% year-over-year increase.

Why this matters- With friendly inflation numbers the Federal Reserve cut interest rates by .50 basis points. The question remains, will this bring back investors to the farmland market?

Link: CPI

Link: Federal Reserve

Fertilizer Prices- Sources I am hearing from say generally;

NH3 Anhydrous Ammonia is around $650 per ton. Potash is $420 per ton. And MAP is $750 per ton.

Why this matters- With tight margins for the 2025 crop year input prices which are always important to pay attention to will be especially important in 2025. I am hearing that some are foregoing fertilizer altogether. This is not surprising with inputs as high as they are.

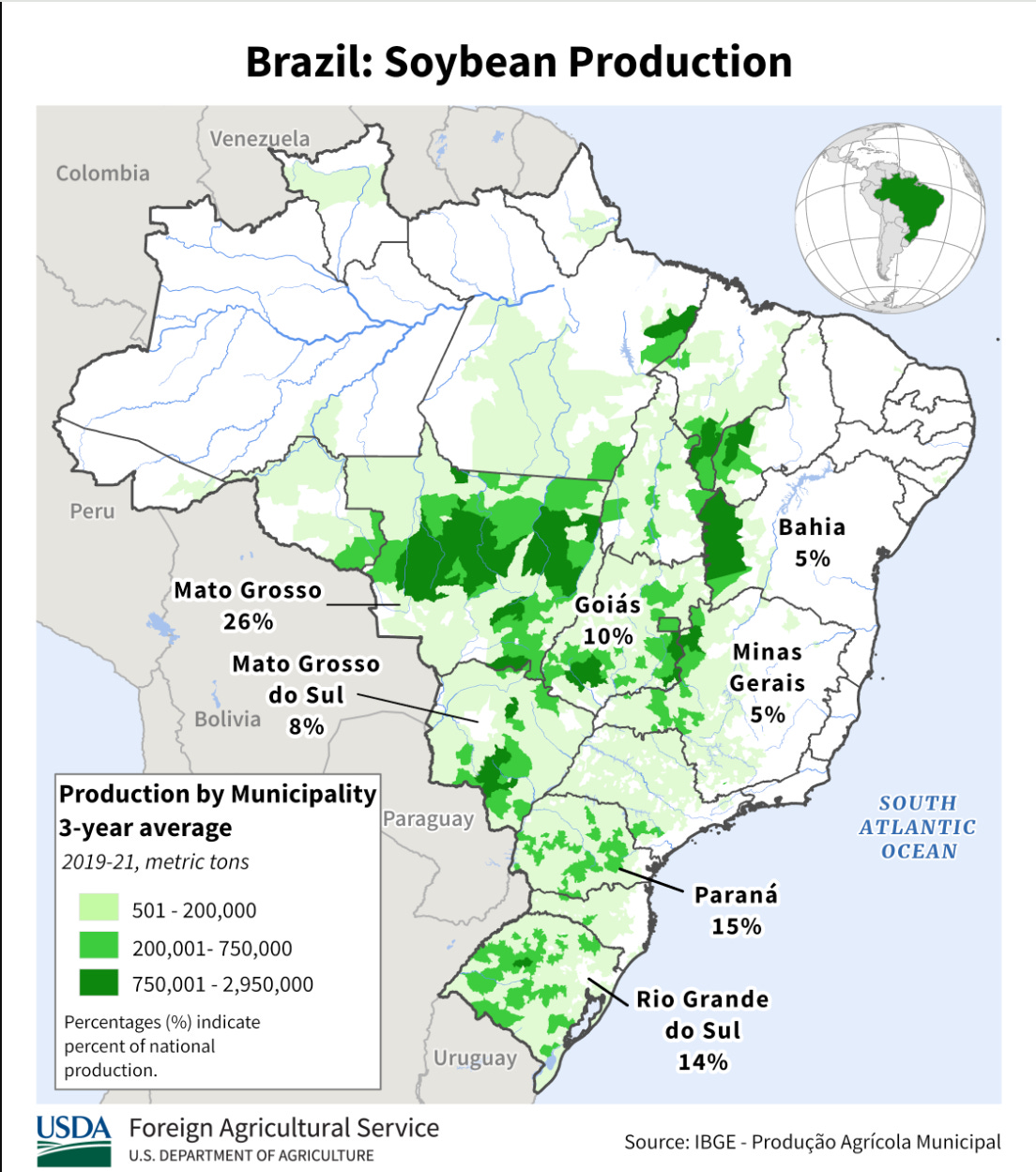

Weather- Our focus will shift to South American weather. Pay attention to the major growing areas like Mato Grosso which comprise 26% of soybean production for South America. It is very hot and dry there currently. If this continues it could be bullish for both the corn and soybean market.

Agriculture News of Note-

Notable Land Sales Video- Check out the video below for notable land sales from Iowa for August!

Thanks for reading the Cornbelt Newsletter! If you are looking to buy or sell a farm or want an evaluation of your property reach out to me.

Contact information: Joshua Manske (Farm Realtor)

Cell: 515-707-1774

Email: joshuahmanske@gmail.com

Thanks for reading the Corn Belt Newsletter! Subscribe for free to receive new posts.