Farm economy continues downturn; Farm debt rising; Tariff study; Farmland sales update

Corn Belt Newsletter for October

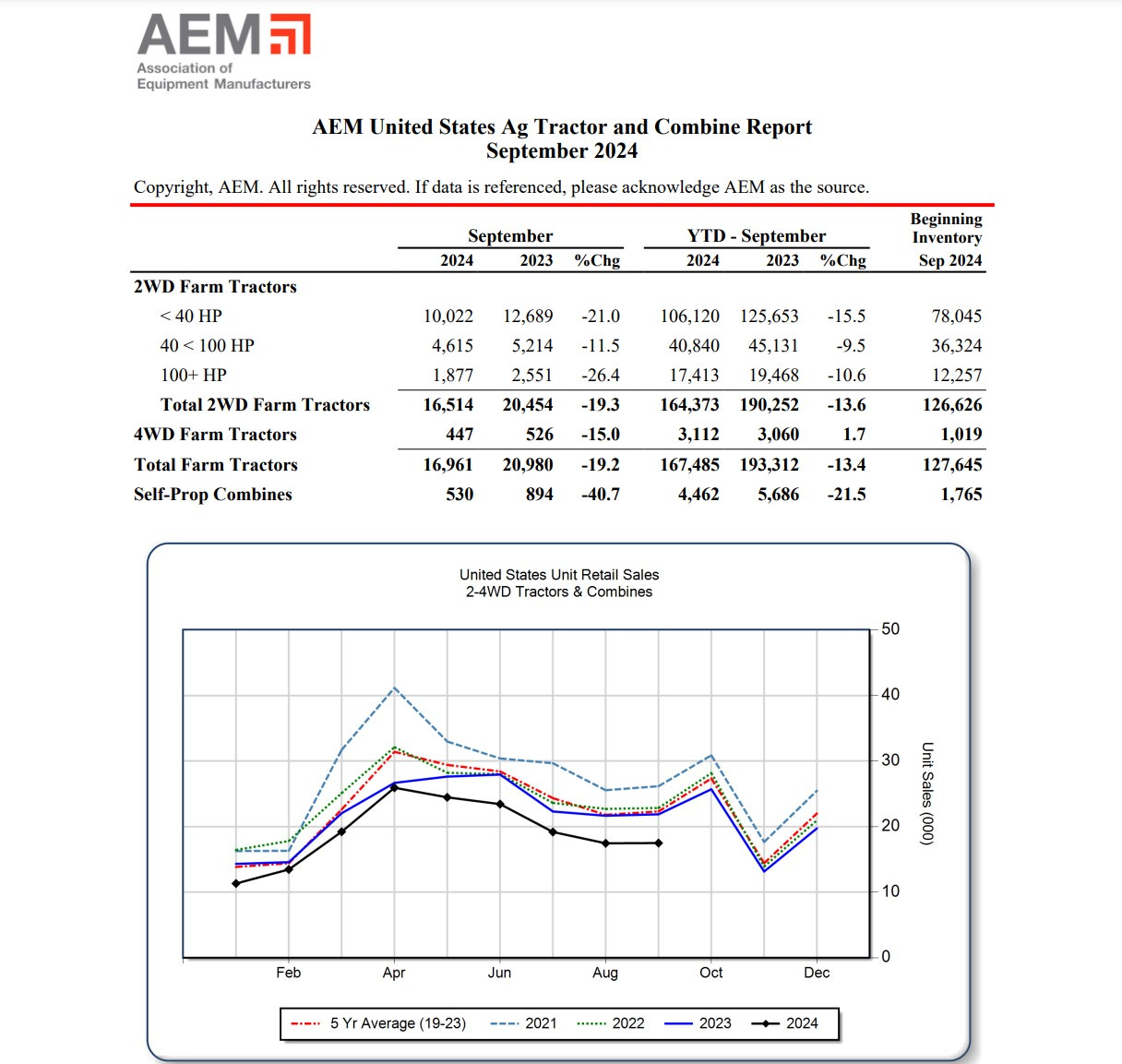

Ag economy continues downturn: The Association of Equipment Manufactures reported recently that the sale of tractors is down 19% from the previous year and combine sales are down 40% compared to 2023. This continues the news we have been seeing over the past few months. The ag economy is struggling with no relief in sight.

LINK: U.S. sales of tractors and combines fall

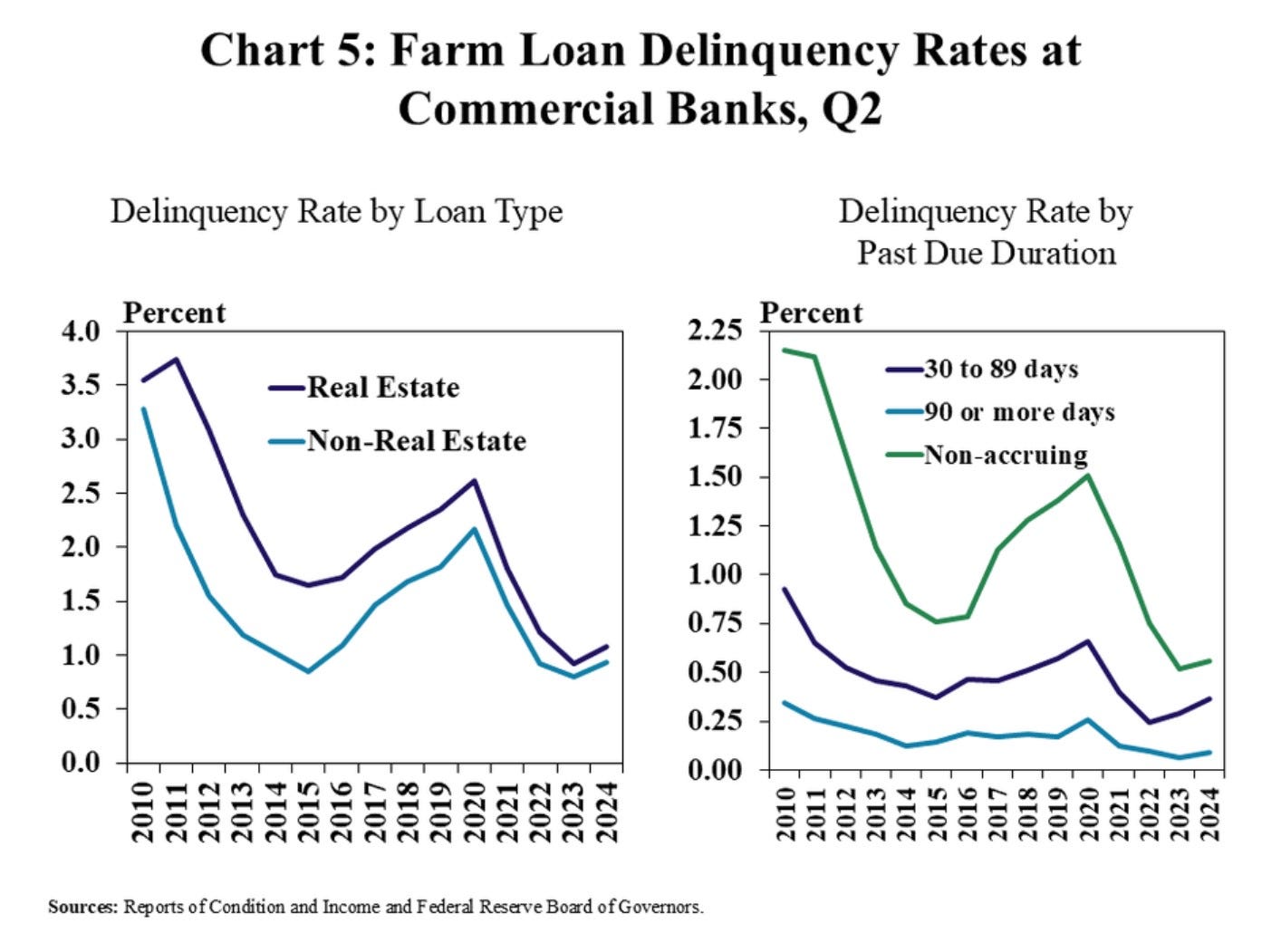

Farm Debt: The Kansas City Federal Reserve reported that farm debt continues to rise. This is not surprising with input prices remaining elevated and commodity prices depressed. The report stated “Credit conditions have tightened along with farm finances in recent months, but loan delinquency rates remained low. About 1% of real estate and non-real estate farm loans were past due at least 30 days in the second quarter, a slight increase from record low levels a year ago. Roughly half of the increase was attributed to newly delinquent loans past due 30 to 89 days.” Read the entire report below.

LINK: Farm debt continues to rise, but delinquencies remain low

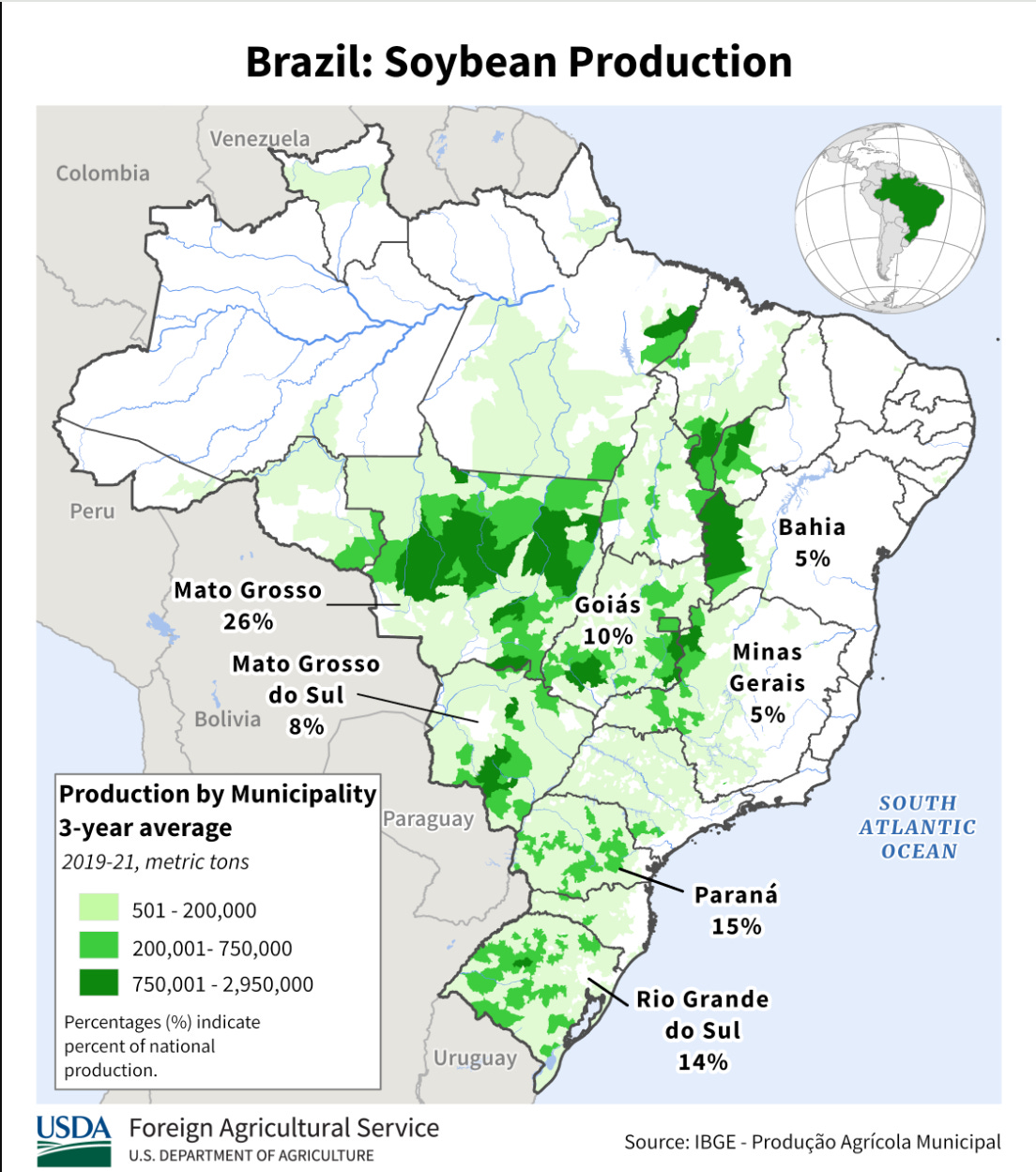

Silver lining? With the ag economy in such a downturn, what could help turn it around? An improvement in exports would be a start, especially for soybeans. Continue to pay attention to South America and its growing season. If their crops struggle that could be a positive for the grain markets. A silver lining is the Federal Reserve’s plan to continue to cut interest rates which should help ease some of the tightness on farmer balance sheets.

Farmland update: Last month’s Realtor Land Institute survey showing land prices decreasing over 8% remains true. Recent land sales show that the land market has continued to soften. However, higher-quality farms with good CSR-2 (soil rating) continue to sell at a premium. If we continue to see commodity prices decline, even with the Federal Reserve lowering interest rates, I would expect the land market to continue to hold or move to the downside. Below are a few sales from the month of September. Check out the video at the end of the newsletter for more land sales from September.

Land Sales:

80 acres sold in O’Brien County, IA. It had a CSR-2 rating of 96 and sold for $15,400 an acre. $160 per CSR-2 point.

80 acres sold in Story County, IA. It had a CSR-2 rating of 86 and sold for $12,400 an acre. $144 per CSR-2 point.

155 acres sold in Wright County, IA. It had a CSR-2 rating of 82 and sold for $9,500 an acre. $115 per CSR-2 point.

Link: Iowa Realtors Land Survey

National Corn Growers Association and the American Soybean Association release tariff study:

The National Corn Growers Association along with the American Soybean Association released a study on the impact of tariffs on agricultural goods. I encourage everyone to read and share the report. The bottom line is that tariffs will hurt our farmers and rural communities.

LINK: NCGA/ASA Tariff Study

Check out the rest of the newsletter for important indicators to pay attention to that affect the land market and agriculture, as well as a video with notable land sales from across Iowa for September.

Commodity Markets:

Corn:

Feed demand- For 2023-2024 feed demand was 5.775 billion bushels. USDA’s latest estimates from the monthly World Agriculture Supply and Demand Estimates (WASDE)report remain unchanged at 5.825 billion bushels of feed and residual use for 2024-2025.

Why it Matters: Feed demand makes up about 40% of corn usage. At these price levels feed demand should stay about the same.

Ethanol: 2023 ethanol demand was 5.45 billion bushels. The recent estimates from the monthly World Agriculture Supply and Demand Estimates (WASDE) left those projections unchanged for 2024-2025 at 5.45 billion bushels.

Why it Matters: Ethanol makes up roughly 40% of corn usage. Continue to watch for the development of the sustainable aviation fuel market. The 45Z tax credit and SAF won’t help prices in the short term but could be critical for supporting prices and demand in the future.

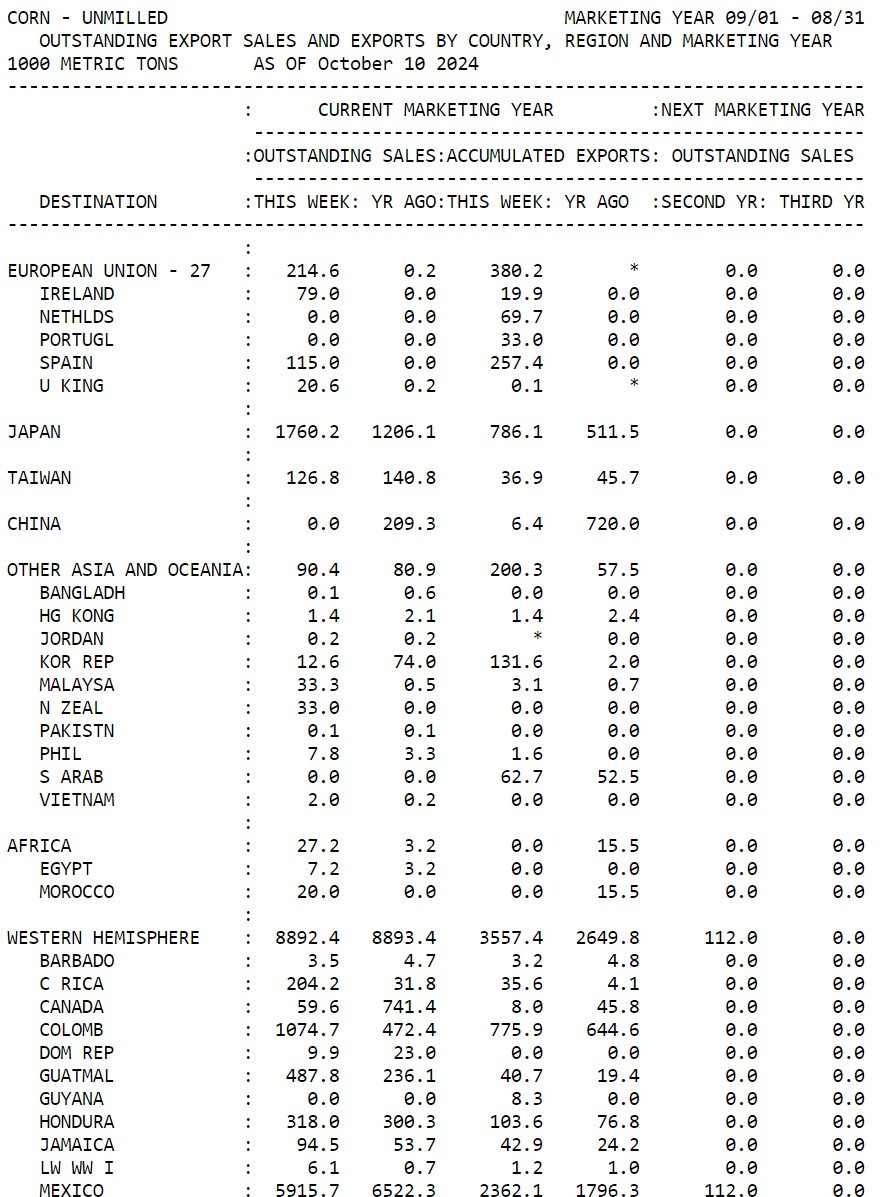

Exports: Projections for corn exports were updated to be 2.325 billion bushels for 2024-2025. Up slightly from USDA’s last estimate of 2.30 billion bushels.

Why it Matters: Exports comprise about 20% of U.S. corn demand. Mexico is our largest buyer of U.S. corn. Last week’s biggest buyer of corn was Mexico. With lower prices, we are starting to see sales in Japan and Taiwan.

Link: WASDE

Link: Exports

Soybeans:

Crush: The National Oilseed Processors Association (NOPA) crush data for September 177.3 million bushels. Last year at this time it was 165 million bushels. This is up 12 million bushels from a year ago.

Why it matters: Roughly half of U.S. soybeans are used for crushing. Soybean oil goes into many products like coffee creamer, salad dressing, and mayonnaise. With crush plant expansion continuing across the United States, expect these numbers to continue higher.

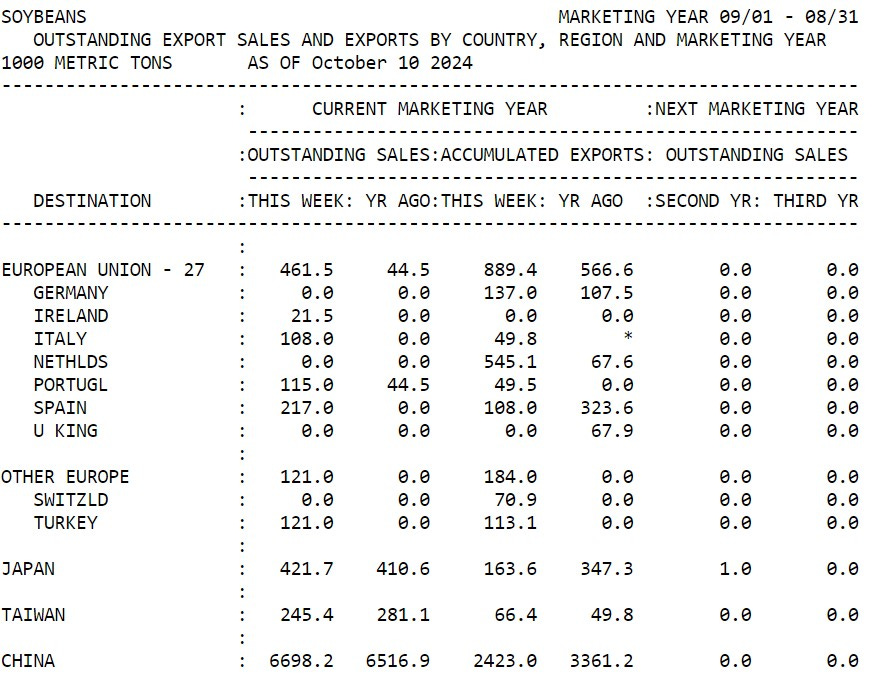

Exports: About half of our U.S. soybean crop is exported. The USDA export projections from the monthly World Agricultural Supply and Demand Estimates (WASDE) showed 1.850 billion bushels of soybeans estimated for export during the 2024/2025 marketing year. China has been our biggest buyer historically. Last week they were our biggest buyer of soybeans. Look for China to continue their buying trend at least until Brazil is more certain of their harvest date.

Link: Exports

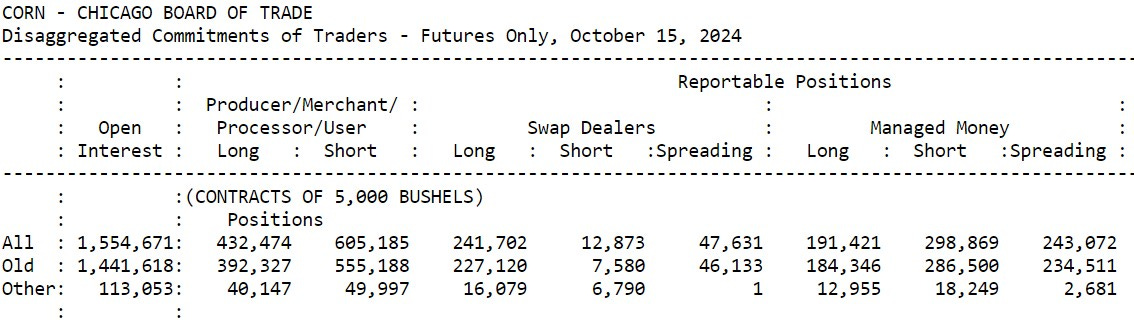

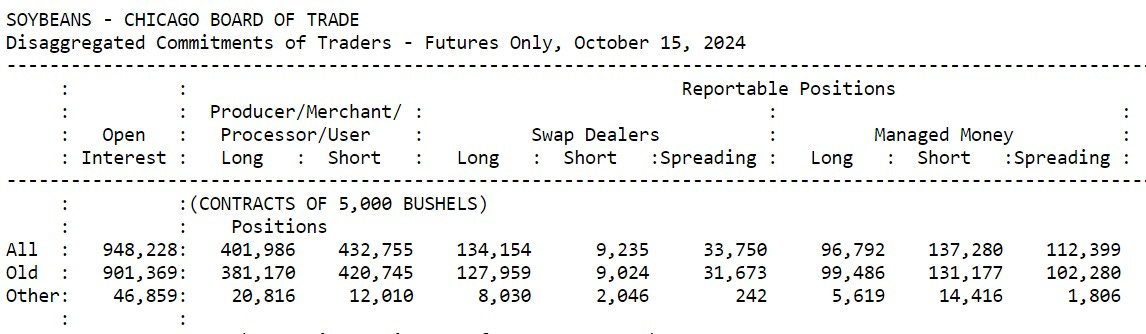

CFTC: Commodity Futures Trading Commission (CFTC) shows Managed Money has a short position in the corn and soybean markets. Short corn contracts of (107,448) and short soybean contracts (40,488).

Why it matters: The funds still hold a net short position however, this is considerably less than it was a few months ago. Continue to watch this space.

Link: CFTC

Interest Rates: The sources I am talking to say yearly operating notes are ranging between 7.0%-8.0%

Why it matters: Lower interest rates will start to help margins for those who borrow money from the bank.

30-year mortgage rates: The current 30-year mortgage rate is 6.25% compared to a year ago when it was 7.5%.

Why it matters: Will lower interest rates start to attract investors back into the farmland market?

Inflation- Monthly Consumer Price Index (CPI) data showed just a 2.4% year-over-year increase. The report stated, “The all items index rose 2.4 percent for the 12 months ending September, the smallest 12-month increase since February 2021.”

Why it matters: With friendly inflation numbers the Federal Reserve is signaling more rate cuts in the coming months.

Link: CPI

Fertilizer Prices: According to the USDA Production Cost report NH3 Anhydrous Ammonia is averaging $684 per ton. Potash is averaging $456 per ton and Phosphate (MAP) is averaging $758 per ton.

Why it matters: With tight margins for the 2025 crop year input prices which are always important to pay attention to will be especially important in 2025. I am hearing that some producers are foregoing fertilizer altogether. This is not surprising with inputs, particularly phosphate being as high as they are.

LINK: Illinois Production Cost

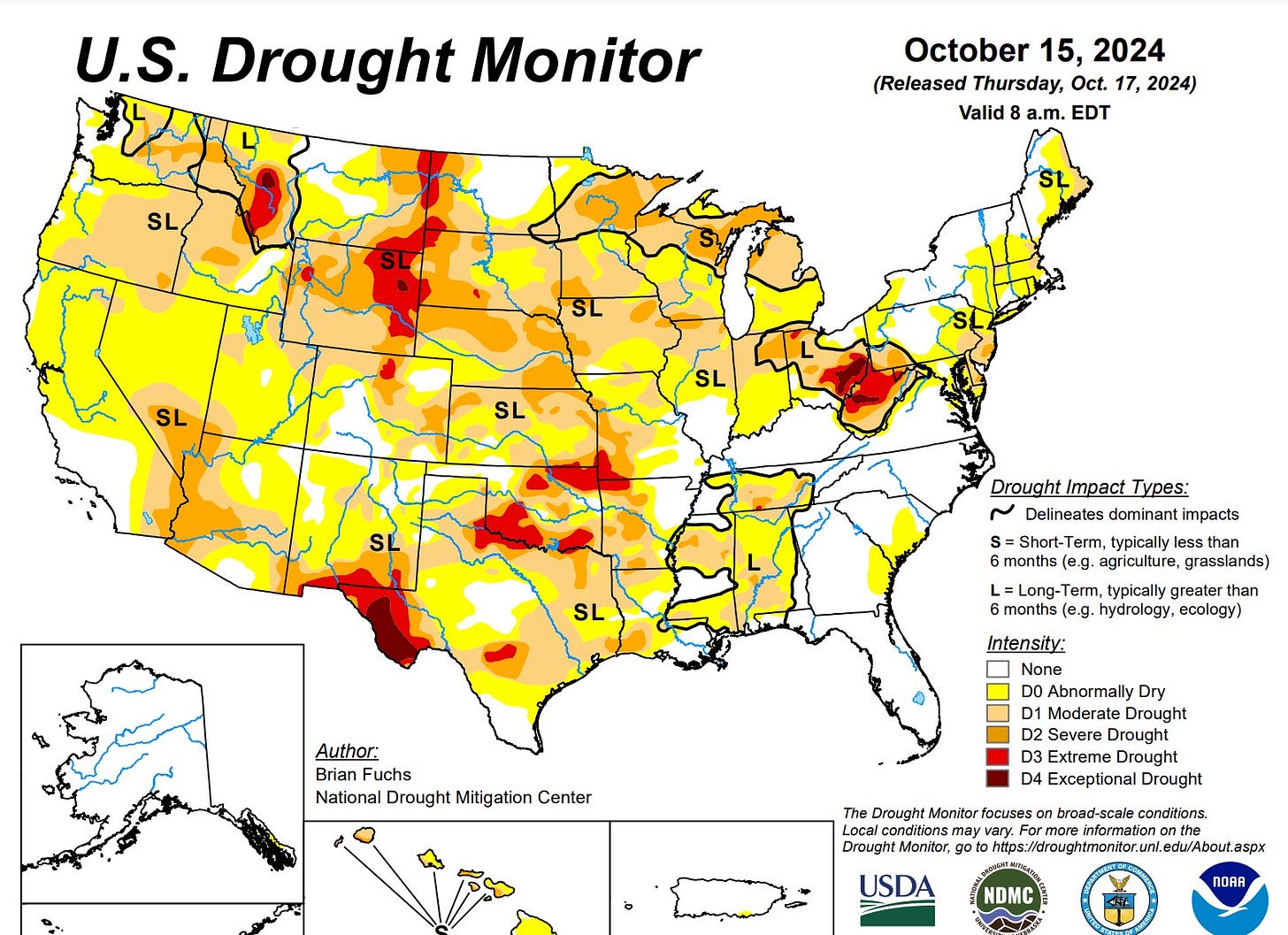

U.S. Drought Monitor: It has been very dry across the corn belt recently. Harvest is humming along at a fast pace. It is so dry in some areas people are damaging tillage equipment.

Weather: Pay attention to the major growing areas like Mato Grosso which comprise 26% of soybean production in South America. Continue to watch the weather in South America for any potential weather scares which would be a positive for the commodity markets.

Agriculture News of Note:

Notable Land Sales Video: Check out the video below for notable land sales from Iowa for September!

Thanks for reading the Corn Belt Newsletter! If you’re looking to buy or sell a farm or want an evaluation of your property reach out to me.

Contact information: Joshua Manske (Farm Realtor)

Cell: 515-707-1774

Email: joshuahmanske@gmail.com